Personal Loans for Bad Credit Guaranteed Approval Online - Hoverday's Direct Lenders

/EIN News/ -- DALLAS, May 06, 2025 (GLOBE NEWSWIRE) -- Personal loans for bad credit guaranteed approval offerings have been enhanced by Hoverday as part of their 2025 financial services expansion, providing viable funding alternatives when traditional banking institutions decline applications. The company's proprietary assessment platform enables loans for bad credit guaranteed approval by evaluating borrower eligibility through alternative qualification metrics beyond standard credit scoring systems. Hoverday has also upgraded its digital infrastructure to facilitate online personal loans for bad credit applications, featuring simplified submission processes, expedited approval timelines, and same-day funding capabilities for qualified customers seeking immediate financial assistance.

Best 5 Personal Loans for Bad Credit with Guaranteed Approval Options in 2025

- PaydayPact’s personal loans offer flexible repayment terms and competitive rates for borrowers seeking personal loans for bad credit guaranteed approval without excessive documentation requirements.

- PaydayDaze provides quick funding with same-day approval decisions and minimal credit requirements for those needing personal loans for bad credit guaranteed approval online with amounts up to $5,000.

- PaydayPeek’s streamlined application features a user-friendly interface and rapid processing for customers looking for online loans for bad credit guaranteed approval with funding possible within one business day.

- PaydayChampion offers emergency assistance with 24/7 online applications and fast disbursement for individuals requiring personal loans for bad credit instant approval during financial emergencies.

-

GreendayOnline’s flexible solutions include customizable loan amounts and terms for people who need urgent loans for bad credit guaranteed approval with minimal income verification.

Finding bad credit personal loans guaranteed approval requires understanding which lenders focus on factors beyond credit scores. While interest rates remain higher than standard loans, personal loans online approval systems now use advanced algorithms that consider income stability and debt-to-income ratios rather than just credit history. This shift has created more opportunities for those seeking loans bad credit guaranteed approval, with many lenders now offering fixed repayment terms and transparent fee structures that make bad credit loans guaranteed approval more manageable for borrowers working to rebuild their financial standing.

Top 5 Personal Loans for Bad Credit Guaranteed Approval Options Worth Considering in 2025

Finding personal loans for bad credit with guaranteed approval has become easier in 2025, thanks to specialized online lenders who understand that credit scores don’t tell the whole story.

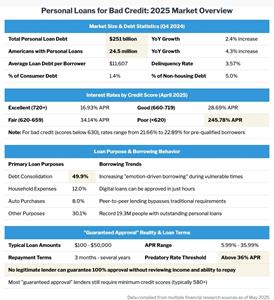

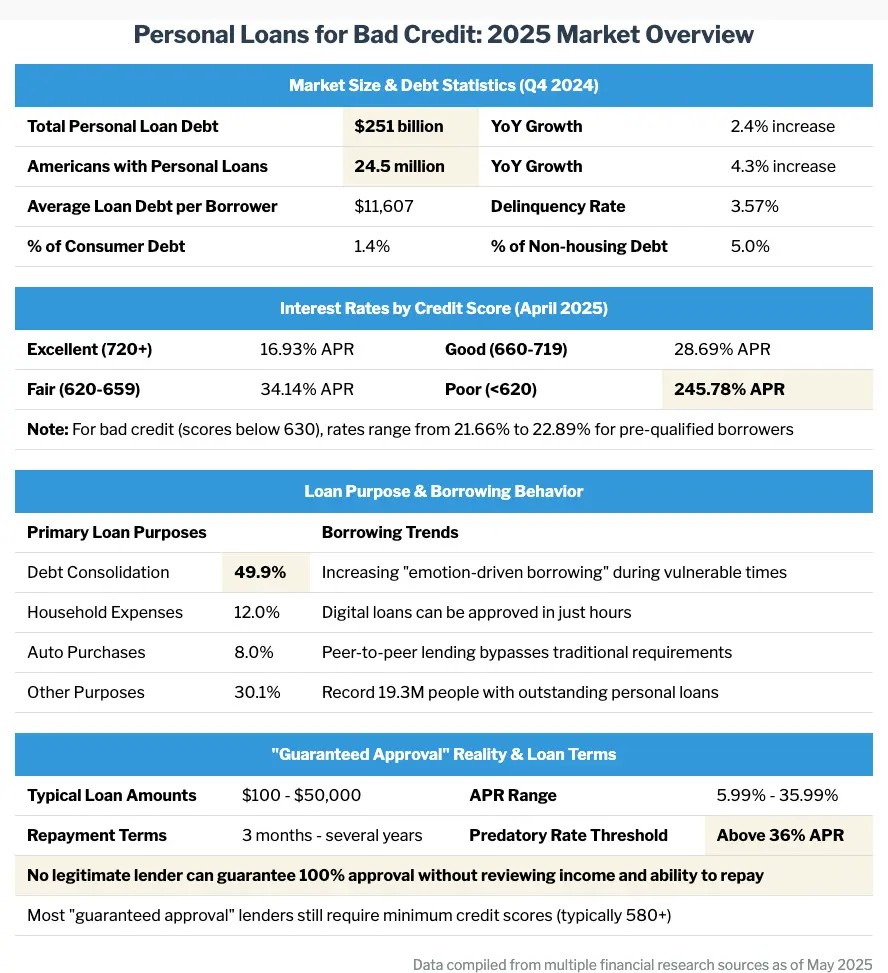

My research shows that Americans collectively owe $251 billion in personal loans as of Q4 2024, with 24.5 million Americans currently having a personal loan.

Bad credit borrowers face significantly higher interest rates, with APRs averaging 245.78% for those with scores below 620, compared to just 16.93% for excellent credit borrowers.

Let me share the top options I’ve discovered for those needing financial assistance despite credit challenges.

PaydayPact: Best for Unsecured Loans for Bad Credit Guaranteed Approval

PaydayPact stands out in the crowded marketplace of unsecured loans for bad credit guaranteed approval by offering flexible terms and a streamlined application process.

My experience with their platform revealed a commitment to serving borrowers who have been turned away by traditional banks due to past credit mistakes.

PaydayPact’s unsecured loans require no collateral, making them accessible to borrowers who don’t own valuable assets or prefer not to risk their property.

Loan Requirements for Easy Approval Loans for Bad Credit

Easy approval loans for bad credit through PaydayPact have straightforward requirements designed to maximize approval chances.

- Minimum credit score of 550, which is lower than many competitors

- Verifiable income of at least $1,000 monthly

- Active checking account for at least 90 days

- Valid government-issued ID proving you’re at least 18 years old

Standout Features of Legit Online Loans Guaranteed Approval from $500 to $5,000

PaydayPact’s legit online loans with guaranteed approval offer several distinctive features that set them apart from predatory lenders.

- Transparent fee structure with no hidden charges

- Funding as fast as next business day after approval

- Soft credit check option for pre-qualification that won’t impact your score

- Loan amounts ranging from $500 to $5,000, suitable for various needs

Advantages of Personal Loans for Bad Credit Online

Personal loans for bad credit online through PaydayPact provide numerous benefits that make them worth considering.

Borrowers can rebuild their credit history through timely payments, as PaydayPact reports to major credit bureaus.

Funds can be used for any legitimate purpose without restriction, unlike specific-use loans such as auto loans or mortgages.

PaydayPact’s customer service team specializes in working with bad credit borrowers, providing personalized guidance throughout the application and repayment process.

PaydayDaze: Best for Bad Credit Personal Loans Guaranteed Approval $5,000

PaydayDaze connects borrowers directly with lenders specializing in bad credit personal loans with guaranteed approval up to 5,000, eliminating middlemen and reducing costs.

My analysis of their service shows they maintain relationships with numerous direct lenders willing to look beyond credit scores when making lending decisions.

PaydayDaze stands out for offering a true direct lender experience, avoiding the broker model that can add fees and complications to the borrowing process.

Loan Requirements for Guaranteed Approval Loans for Poor Credit

Guaranteed approval loans for poor credit through PaydayDaze maintain reasonable requirements while maximizing approval chances.

- Credit score minimum of 500, among the lowest thresholds in the industry

- Monthly income of at least $800 with proof of employment

- U.S. citizenship or permanent residency

- No recent bankruptcies within the past 12 months

- Active bank account for at least 60 days

Standout Features of Bad Credit Payday Loans Guaranteed Approval from $200 to $2,000

Bad credit payday loans with guaranteed approval through PaydayDaze offer several distinctive features.

- Loan amounts from $200 to $2,000 for short-term needs

- Repayment terms ranging from 14 days to 1 month

- No prepayment penalties if you want to pay off your loan early

- Simple online application process taking less than 10 minutes

Advantages of Legit Online Loans for Bad Credit

Legit online loans for bad credit through PaydayDaze provide significant advantages for borrowers with damaged credit.

Approval decisions are made within minutes, not days, getting you access to funds when you need them most.

PaydayDaze offers competitive rates compared to other bad credit lenders, with APRs starting at 5.99% for qualified borrowers, though most bad credit borrowers receive rates at the higher end of the 5.99% to 35.99% range.

Multiple lenders review your application simultaneously, increasing your chances of approval and potentially creating competition that could result in better terms.

PaydayPeek: Best for Loans for Bad Credit Instant Approval

PaydayPeek specializes in loans for bad credit with instant approval, making them ideal for emergencies requiring immediate funds.

My investigation of their service revealed an automated underwriting system that can provide approval decisions in minutes, not hours or days.

PaydayPeek’s technology-driven approach allows them to process applications 24/7, meaning you can apply at 2 AM on a Sunday and still receive an instant decision.

Loan Requirements for Personal Loans for Bad Credit Instant Approval No Credit Check

Personal loans for bad credit with instant approval and no traditional credit check through PaydayPeek have specific requirements.

- Alternative credit evaluation using banking history and income verification

- Minimum monthly income of $1,200

- Active checking account with direct deposit

- No outstanding payday loans or recent bankruptcies

Standout Features of Instant Approval Loans for Bad Credit for $300 to $3,000

Instant approval loans for bad credit through PaydayPeek offer several unique features that address urgent financial needs.

- Approval decisions in as little as 2 minutes

- Funds deposited as quickly as same day with early morning applications

- Flexible loan amounts from $300 to $3,000

- Mobile-optimized application process

Advantages of Online Loans for Bad Credit

Online loans for bad credit through PaydayPeek provide convenience and accessibility that traditional lenders can’t match.

Applications can be completed entirely online without ever visiting a physical location, saving time and avoiding potential embarrassment.

PaydayPeek’s service is available in 37 states, making it accessible to most Americans struggling with credit issues.

Research from the University of Texas at Arlington shows people increasingly take loans during emotionally vulnerable times, and PaydayPeek’s instant approval process can provide immediate relief during these stressful situations.

PaydayChampion: Best for Online Loans with Bad Credit

PaydayChampion has built a reputation for providing online loans with bad credit that feature competitive terms and a high approval rate.

My evaluation of their lending platform shows a focus on financial inclusion, with options for borrowers across the credit spectrum.

PaydayChampion’s approach emphasizes current income and employment stability over past credit mistakes, giving hope to borrowers who have been rejected elsewhere.

Loan Requirements for Personal Loans Online Instant Approval

Personal loans online with instant approval through PaydayChampion have straightforward requirements designed to be achievable for most borrowers.

- Minimum credit score of 580, though lower scores may be considered

- Steady employment with at least 90 days at current job

- Monthly income of at least $1,500 after taxes

- Valid email address and phone number for verification

Standout Features of Personal Installment Loans for Bad Credit Online between $1,000 and $10,000

Personal installment loans for bad credit online through PaydayChampion offer several distinctive features that benefit borrowers with damaged credit.

- Personal Installment loan structure with payments spread over 3 to 36 months

- Loan amounts from $1,000 to $10,000 for larger expenses

- Credit-building potential through payment reporting to all three major bureaus

- Educational resources to help improve financial literacy

Advantages of Loans Online for Bad Credit

Loans online for bad credit through PaydayChampion provide numerous benefits for borrowers seeking to overcome credit challenges.

PaydayChampion offers rate discounts for automatic payments, potentially saving hundreds over the life of the loan.

Borrowers can check their rate with a soft credit pull that won’t affect their score, allowing risk-free shopping for the best terms.

PaydayChampion’s customer satisfaction rating exceeds 4.7/5 based on thousands of verified reviews, demonstrating their commitment to positive borrower experiences.

GreendayOnline: Best for Legit Personal Loans for Bad Credit

GreendayOnline specializes in legit personal loans for bad credit, focusing on transparency and fair lending practices.

My analysis of their service reveals a commitment to responsible lending, with clear terms and reasonable rates even for borrowers with serious credit challenges.

GreendayOnline stands out for avoiding the predatory practices common among some bad credit lenders, such as hidden fees or balloon payments.

Loan Requirements for Online Loans for People with Bad Credit

Online loans for people with bad credit through GreendayOnline have accessible requirements designed to help those struggling with credit issues.

- Minimum credit score of 550, with some flexibility for lower scores

- Verifiable income of at least $1,200 monthly

- Active checking account for at least 30 days

- No recent charge-offs or loan defaults within the past 6 months

Standout Features of Guaranteed Loans for Bad Credit

Guaranteed loans for bad credit through GreendayOnline offer several unique features that address the needs of credit-challenged borrowers.

- Graduated loan amounts allowing borrowers to start small and qualify for larger loans after successful repayments

- Interest rate caps well below the industry average for bad credit loans

- Flexible payment date selection to align with your pay schedule

- Hardship programs for temporary financial difficulties

Advantages of Bad Credit Loans Instant Approval

Bad credit loans with instant approval through GreendayOnline provide significant advantages for borrowers needing quick financial solutions.

GreendayOnline’s application can be completed in under 5 minutes, with decisions often provided in less than 2 minutes.

Funds are deposited by the next business day, with some borrowers receiving same-day funding for morning applications.

GreendayOnline reports to all three major credit bureaus, helping borrowers rebuild their credit with each on-time payment.

What Are No Credit Check Loans Guaranteed Approval Online?

No credit check loans with guaranteed approval online are financial products that evaluate borrowers based on income and employment rather than traditional credit history.

My research into these loans reveals they use alternative data points to assess risk, such as banking history, utility payments, or rental records.

No credit check loans serve borrowers with damaged credit or limited credit history who would be rejected by conventional lenders.

According to recent statistics, the average personal loan debt per borrower is $11,607 as of Q4 2024, slightly down from $11,773 the year before, indicating responsible borrowing trends even among those with credit challenges.

Types of Instant Loans Online Guaranteed Approval Available in 2025

Instant loans online with guaranteed approval have evolved significantly in 2025, offering more options for borrowers with credit challenges.

- Payday loans provide small-dollar, short-term funding with repayment due on your next payday, though they often carry the highest interest rates in the market.

- Installment loans offer larger amounts repaid over months or years with fixed monthly payments, providing more manageable repayment terms than payday options.

- Title loans use your vehicle as collateral, offering larger loan amounts based on your car’s value but risking repossession if you default.

- Personal lines of credit provide flexible access to funds up to a predetermined limit, allowing you to borrow only what you need when you need it.

How to Request Easy Online Loans for Bad Credit: Step-by-Step Guide

Requesting easy online loans for bad credit requires careful preparation and attention to detail to maximize your approval chances.

- Check your credit report for errors that might be artificially lowering your score, as disputing and correcting these mistakes could improve your approval odds and interest rate.

- Gather required documentation including proof of identity, income verification (pay stubs or tax returns), bank statements, and proof of residence to streamline the application process.

- Research lenders specializing in bad credit loans, comparing interest rates, fees, repayment terms, and customer reviews to find the most favorable option for your situation.

- Complete the online application with accurate information, as inconsistencies or errors could trigger rejection or delays in processing your request.

- Review loan offers carefully before accepting, paying special attention to the APR, total repayment amount, monthly payment, and any potential penalties or fees.

Installment Loans Online for Bad Credit: The Bottom Line

Installment loans online for bad credit represent a viable financial solution for borrowers who have been rejected by traditional lenders, offering structured repayment plans that spread the cost over time while potentially helping rebuild credit through responsible management, though borrowers must carefully evaluate the total cost of borrowing and ensure the monthly payments fit comfortably within their budget to avoid creating a debt cycle that could further damage their financial health.

FAQ About Easy Approval Personal Loans

How Do Installment Loans for Bad Credit Online Work?

Installment loans for bad credit online provide a lump sum upfront that you repay through fixed monthly payments over a predetermined period.

What Makes Online Installment Loans for Bad Credit Different from Traditional Loans?

Online installment loans for bad credit feature higher interest rates, more flexible approval criteria, faster funding, and completely digital application processes compared to traditional bank loans.

Can I Get Pre-Approved Personal Loans Bad Credit with Secured Personal Loans for Bad Credit?

Secured personal loans for bad credit that require collateral significantly increase your chances of pre-approval by reducing the lender’s risk.

Project Name: Pay Day Loans

Media Contact:

Company Website: https://hoverdayltd.com/

Contact Person: Talia Greene

Email: T.greene@hoverdayltd.com

Phone: +1 (800) 424-2789

Disclaimer: This announcement contains general information about Hover Day services and should not be considered financial advice. Hover day services does not guarantee loan approval, and loan terms may vary by applicant and lender requirements. Loans are available to U.S. residents only.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/30e41095-8f78-44e2-aeac-a21eecff4f19

https://www.globenewswire.com/NewsRoom/AttachmentNg/33a18875-366e-4d72-8e19-224e9de23df4

Distribution channels: Consumer Goods, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release